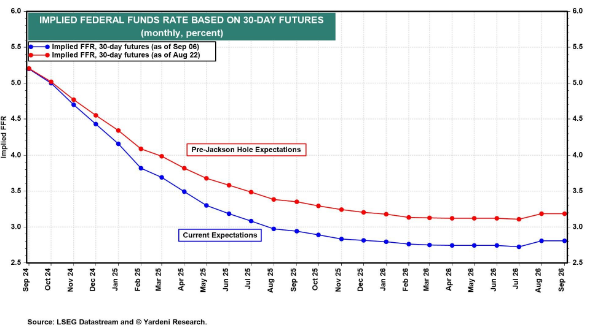

The chart of the week examines the projected Federal Funds rate for the next two years and the difference of pre and post Jackson Hole meetings. There has been much discussion about interest rates and the potential impact of rate cuts on money markets and “T-Bill and Chill,” but this chart should provide more clarity. Based on current expectations, it is projected that by December 2025, the Federal Funds rate could reach around 3% and potentially dip into the 2% range. As we have previously emphasized, it’s important to have a plan in place if you have a significant allocation to cash, money markets, or short-term bonds.