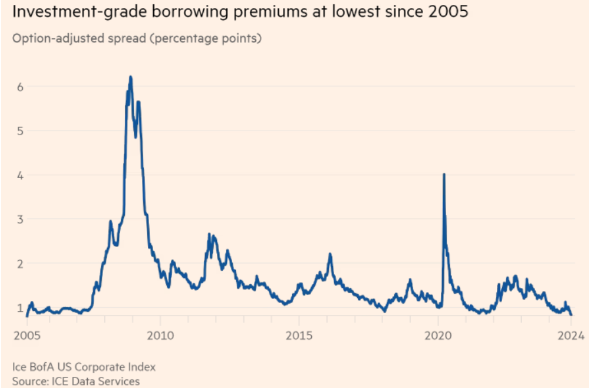

The chart of the week examines the spread, or the additional yield earned by investing in corporate bonds compared to Treasury bonds. This spread represents the extra return required to compensate for the potential default risk associated with corporations, as opposed to government bonds. Recently, this spread fell to its lowest level since March 2005, at 0.83%. This decline indicates that investors have confidence in the strength of the economy and likely anticipate a continued soft landing as the Federal Reserve begins to cut interest rates. Spreads are utilized across the fixed income spectrum to identify where investors are either adequately or inadequately compensated for taking on risks beyond those associated with Treasury securities and are a key tool in managing fixed income portfolios.