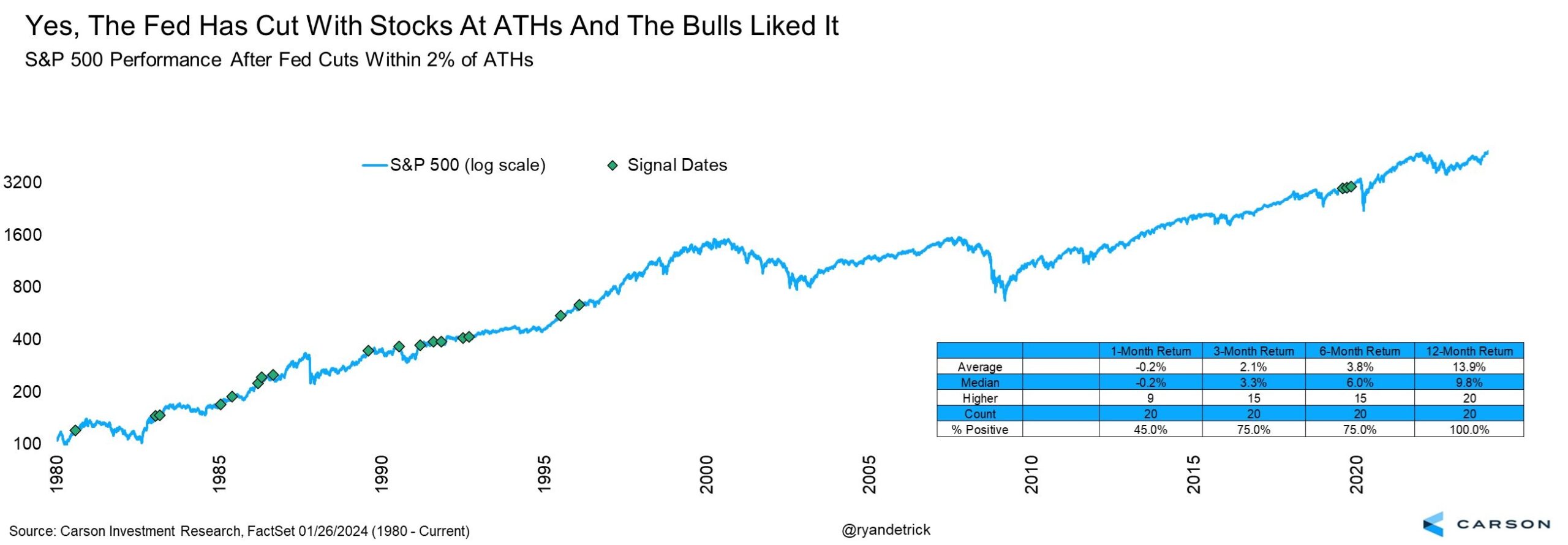

The chart of the week examines a possible future scenario: the Federal Reserve cutting interest rates when stocks are at or near their all-time highs. The historical data shows that when the Fed has cut rates of the S&P 500 index within 2% of its all-time high, the market has seen positive returns 75% of the time after both 3 and 6 months, and 100% of the time (20 out of 20 occurrences) the market was higher after a full year. Although rate cut expectations have decreased through the first half of 2024 from 4-6 cuts to possibly one, should markets continue higher, this could be a potential scenario.