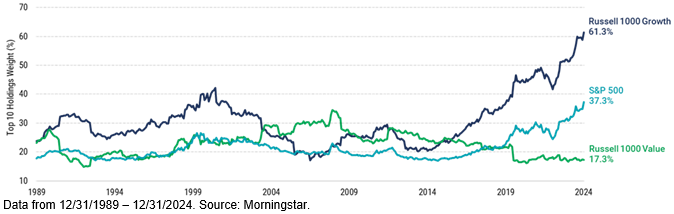

The chart of the week examines the concentration of the top 10 holdings across three major equity indices over time. There has been considerable discussion about the concentration risk in the S&P 500, which has reached an all-time high allocation of 37.3% to its top 10 holdings. However, an even greater concentration is observed in the Russell 1000 Growth index. Over the past decade, the concentration of the top 10 names has nearly tripled, now accounting for 61.3% of the Russell 1000 Growth index. While concentration can have both positive and negative effects depending on the performance of these 10 companies, it is essential for investors to assess the risk they are willing to take. In contrast, the Russell 1000 Value index is significantly more diversified, with only 17.3% allocated to its top 10 companies, which is near the lowest level since 1990.