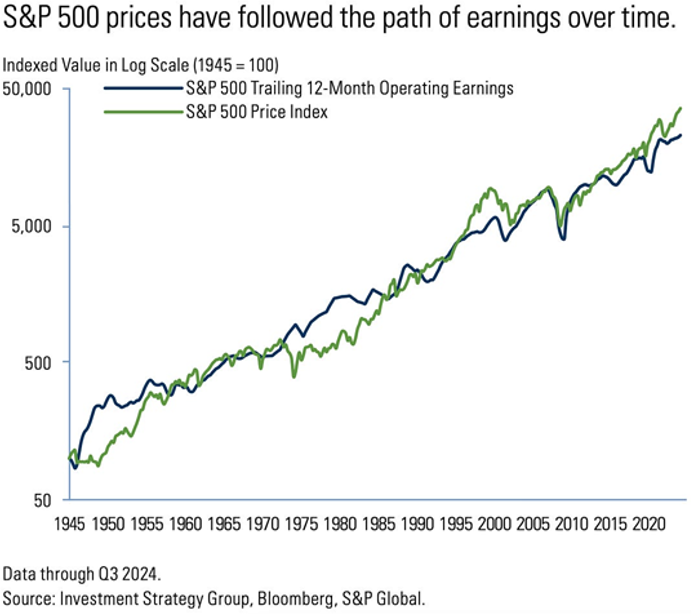

The chart of the week overlays the S&P 500 with 12-month trailing earnings, dating back to 1945. Trailing earnings represent the index’s total profits over the past year. What has driven the consistent growth of U.S. corporate earnings over time? Productivity, market expansion, and pricing power all play key roles, but the primary factor is economic growth. As the economy expands, consumer demand rises, leading to higher sales. Increased sales typically boost profit margins, as some costs remain fixed and do not scale with revenue. History shows a strong correlation between earnings growth and stock prices, reinforcing that earnings are the most important long-term driver of market performance.