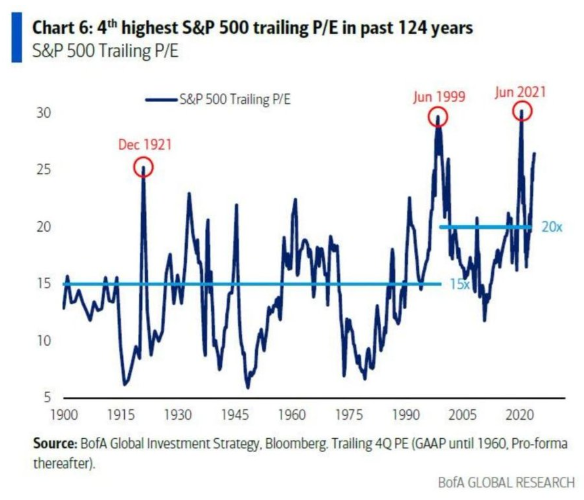

This week, we analyze the trailing price-to-earnings (P/E) ratio for the S&P 500, spanning over 120 years of market data. The findings show that the current P/E ratio is the fourth-highest in history, following peaks in 1921, 1999, and 2021. Investors often favor buying stocks when the P/E ratio is lower, as it signals a more attractive valuation. While entry price is a strong indicator of long-term investment performance, its predictive value tends to wane over shorter time horizons. As always, staying informed and cautious remains key to navigating market trends effectively.