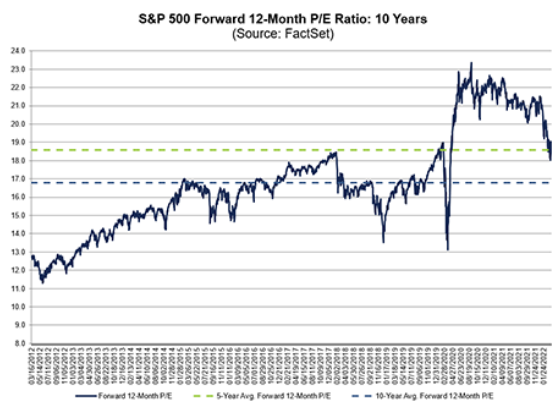

The chart of the week looks at the price to earnings ratio, or P/E ratio, which is a common valuation metric for the equity markets and in this case the S&P 500. Valuations using this metric come down, or become cheaper, for two reasons. One is because future earnings growth increases, which is what we saw last year. In 2022 , however, the P/E ratio has fallen mostly because prices have fallen. The combination of price declines and earnings expectations increasing has led to a P/E level below the 5 year average and moving closer to the 10 year average.