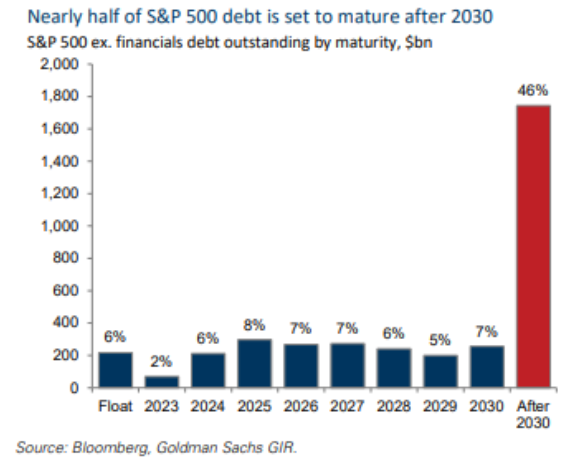

The chart of the week looks at the maturities of debt issued by the S&P 500 companies, minus the financials sector. As you can see, companies did a very good job locking in low interest rates and extending the maturity of that debt, with 46% of the debt maturing after 2030. This will be a big tailwind for companies moving forward if we continue in a higher interest rate environment. This will have a similar affect that locking in a low mortgage will have on personal balance sheet, with many homeowners locking in 30-year mortgages at very low rates.