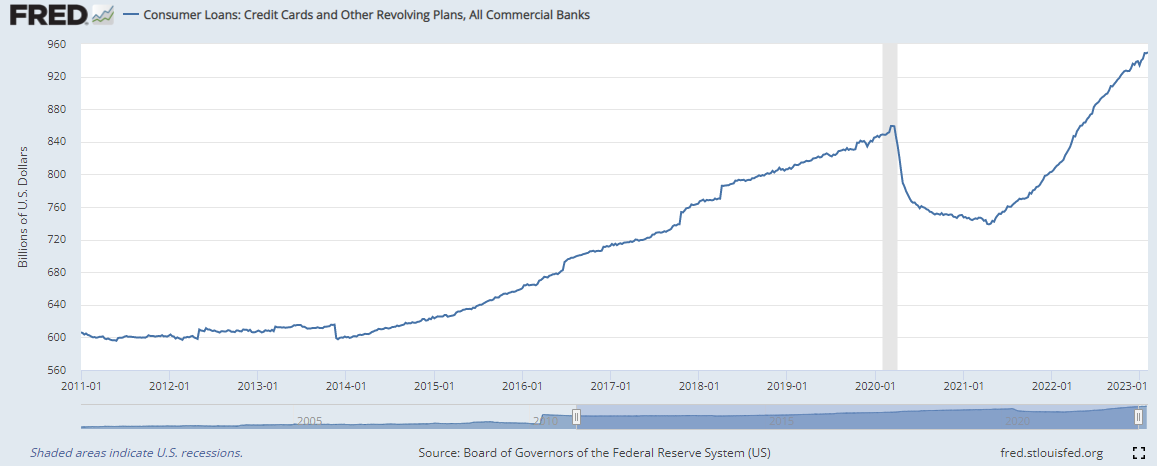

The chart of the week looks at consumer loans which includes credit cards and other types of revolving loans. From 2011 through 2014, debt levels stayed about the same as many were likely still afraid of the large debts they accumulated prior to the financial crisis and the effect those had on their lives. But from 2014 to March 2020, we saw consumer loans increase about 40%! This ended as the pandemic took hold and consumers started to save up cash while consumer debt decreased by about 15%. Since debt bottomed in April 2021, we have seen consumer debt increase another 28% in just over a year and a half! A huge increase and something to keep an eye on as inflation remains high and rates could potentially go even higher.