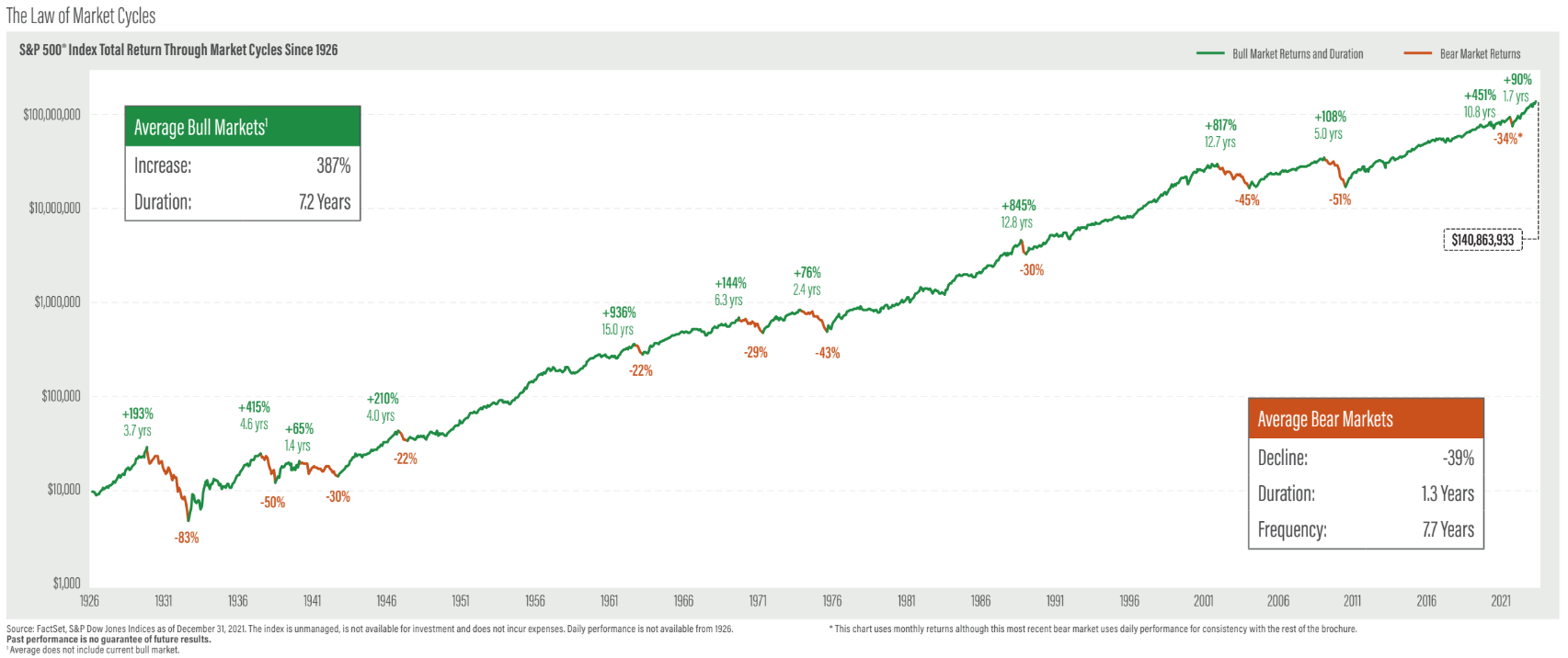

The chart of the week shows bull and bear markets for the S&P 500 since 1926. Usually bull markets, when markets go up by 20% or more, last much longer than bear markets and on average last over 7 years. Bear markets, when markets drop more than 20%, tend to be much shorter and last a little over a year on average. Bear markets have occurred 11 times since 1926 and occur around every 7 and a half years. Long story short, if you are invested in the markets long enough you will likely experience both! So be prepared for the ups and the downs.

The S&P 500 is an unmanaged index of 500 widely held stocks that is generally considered representative of the U.S. stock market. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.