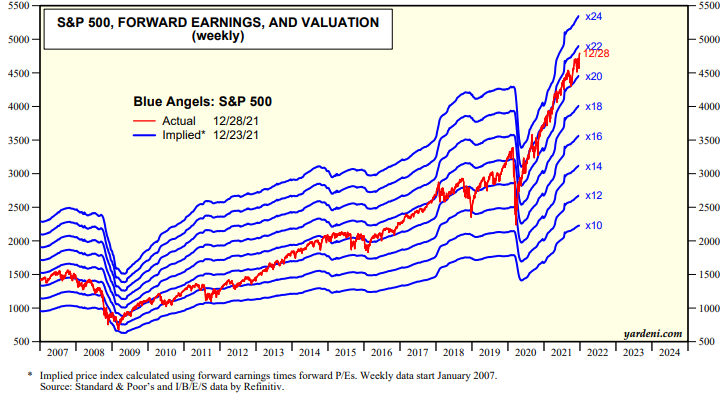

With equity markets continuing to perform well, equity valuations remain elevated. To get a gauge on how expensive equity markets are, we can look at the current price index (red line) compared to different levels of market multiples that are based on the next 12 months forward earnings (blue lines). At the moment, the Forward P/E on the S&P 500 is 21.21, well above average and at the higher end of the valuation ranges shown below. While that is a sign of caution for equity market returns going forward, one way that valuations can return to normal is for corporate earnings to grow at an above average clip which is expected, shown via the slope in the valuation multiples. The steeper the slope, the faster earnings are growing, and as shown, the slope remains well above historical average.

Source: Yardeni