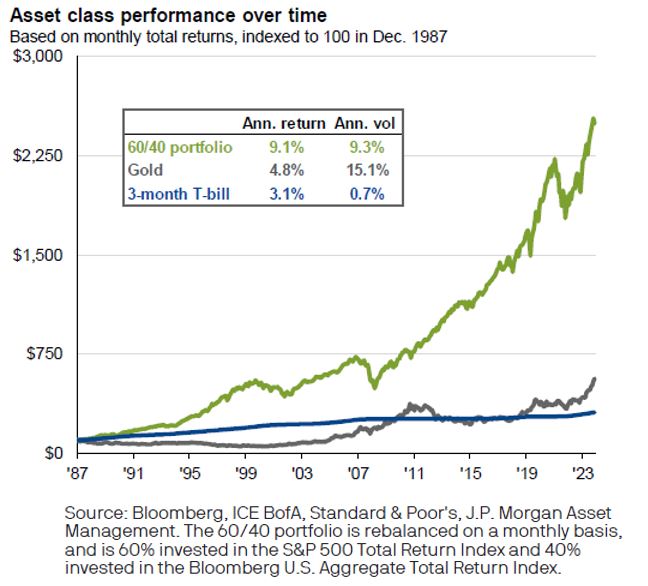

The chart of the week compares a diversified 60% stock/40% bond portfolio with the returns of gold and cash investments going back to 1987. Gold has received considerable attention in recent months and is on pace for its best year since 1979. Gold investors tend to gravitate toward the shiny metal in times of inflation, market volatility, and geopolitical uncertainty. While gold can play a defensive role in a diversified portfolio, long-term investors ought to not overlook the benefits of traditional stocks and bonds, which over time have produced stronger returns with less volatility. Corporations can expand, innovate, and generate profits over time, while gold is viewed more so as a safe haven and store of value. In addition, dividend and interest payments present in stock and bond investments allow for greater long-term compound growth, a feature not found within gold or other precious metals.