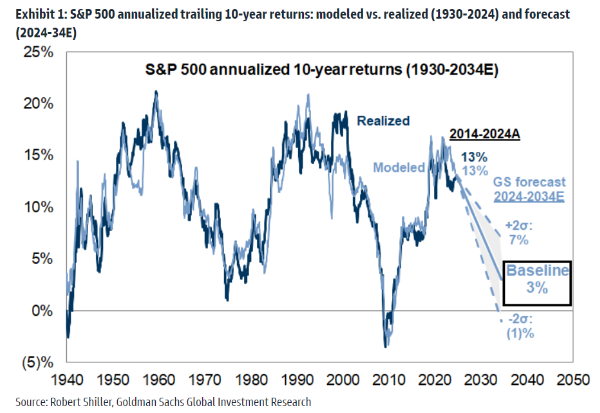

The chart of the week examines a recent estimate from Goldman Sachs. Their research predicts a significantly different trajectory for the S&P 500 over the next 10 years compared to the past decade. They forecast an annualized return of just 3% per year, in contrast to the 13% annualized return we have experienced over the last 10 years. Some possible reasons for these lower estimates include increased competition from other asset classes, high concentration within the S&P 500 and historically above-average valuations. This is just one prediction, but a somewhat similar situation occurred in the 1950s and 1960s, as well as in the late 1990s when market returns were heavily influenced by a small number of companies. In the following years, returns were less than favorable.